Hedge the Risk, Survive the Dip

Decentralized Risk and Asset Management

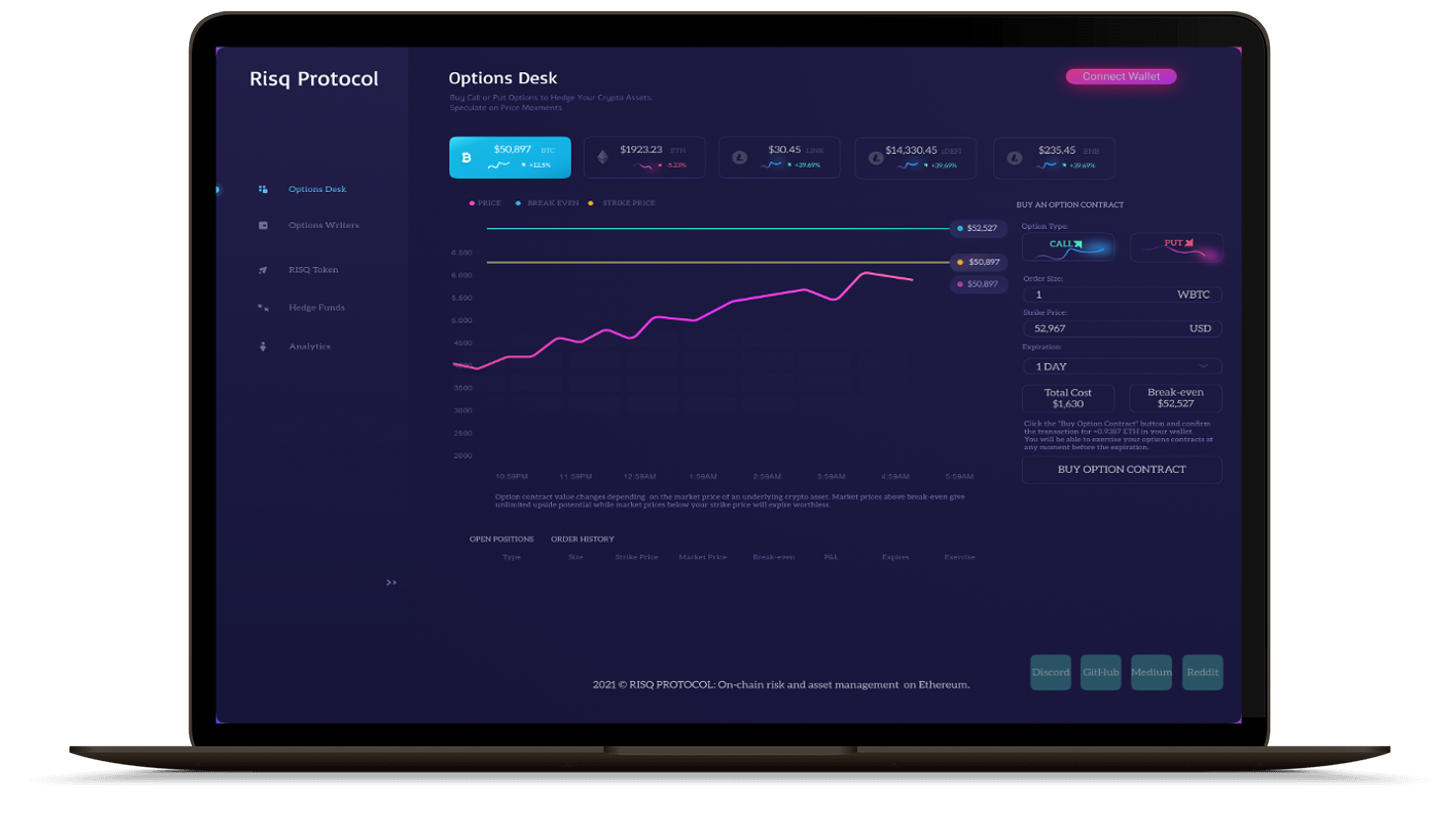

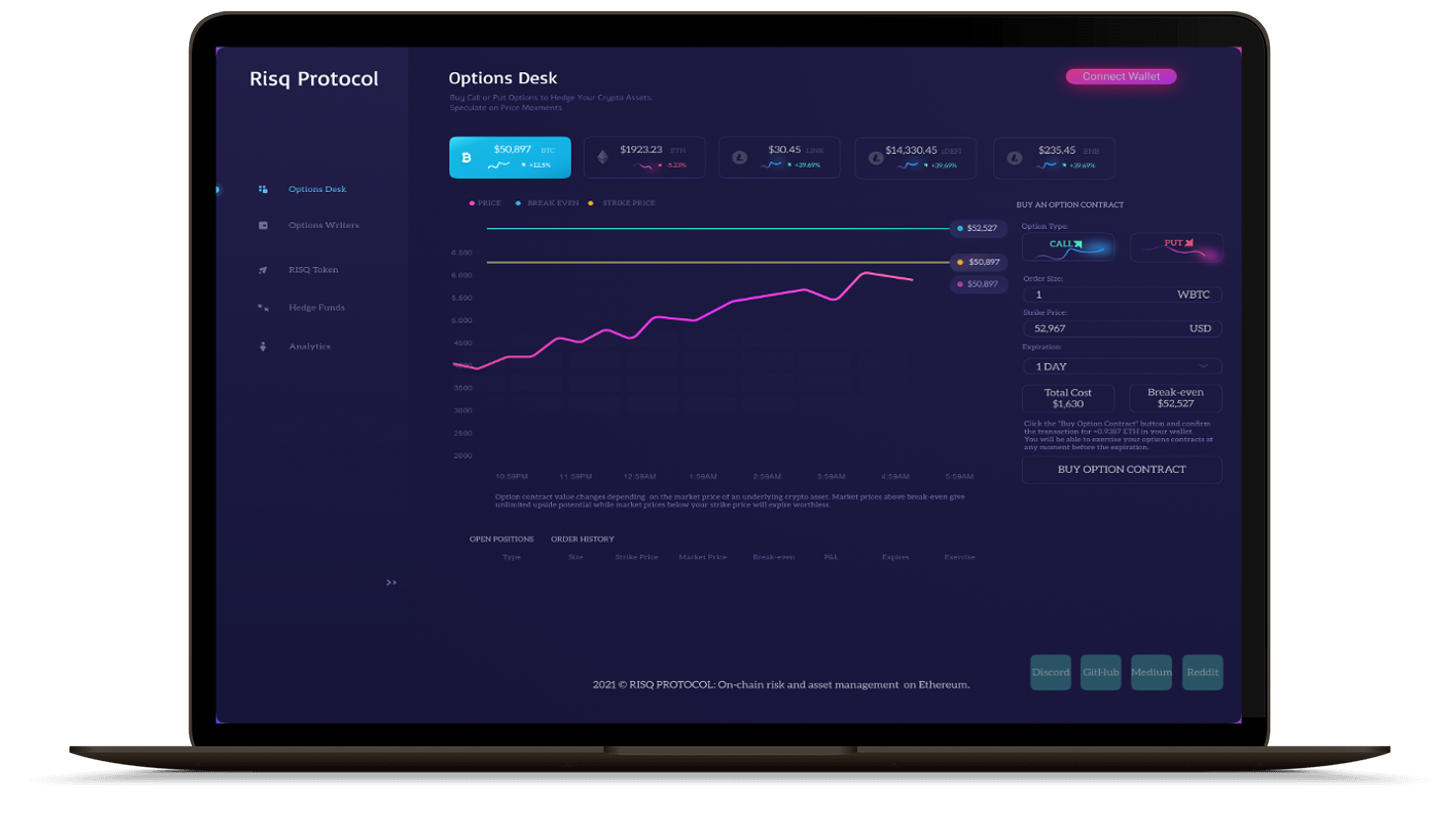

Speculate or protect your crypto holdings against price dips with on-chain Call and Put options. Build DeFi hedge funds for asset managers, investors, and traders.

Speculate or protect your crypto holdings against price dips with on-chain Call and Put options. Build DeFi hedge funds for asset managers, investors, and traders.

Buying Call Options can be an excellent way to buy the dip with less capital at risk. Call Options provide leverage without the margin requirments.

Investors and traders looking to protect thier crypto assets from short term price dips can buy Put Options. Profit from the downside while you HODL.

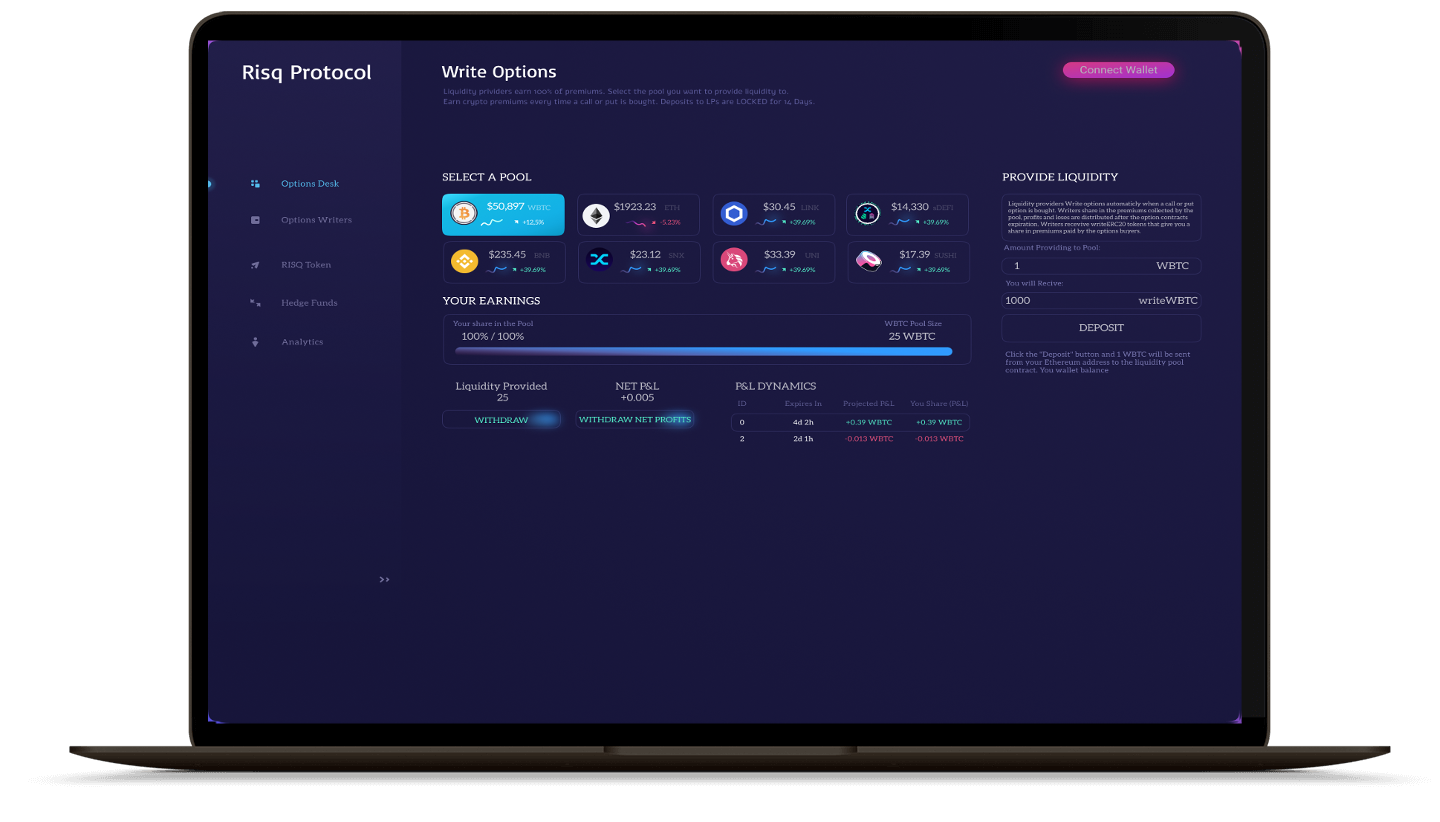

Options DeskLiquidity providers deposit tokens on which they wish to write (sell) options. LPs earn 100% of the premium (sale price) every time a call or put is purchased.

Call and Put options are purchased in ETH or BNB, which is paid to the LPs. Buyers choose the strike price and pay a settlement fee of 1% to RISQ holders.

RISQ holders earn rewards in the underlying crypto they want to stake. These rewards can be claimed immediately after a call or put is purchased.

Once an option is either exercised or expires the option premium P&L; is distributed to Liquidity Providers. Withdraw profits with out having to remove Liquidity.

An option contract can be exercised before the expiration time either to take a profit if it is in the money or at a loss if it is out of the money.

Buyers choose an expiration time of 1 day to 4 weeks. If an option is out of the money at expiration it expires worthless and 100% of the premium paid is released to LPs

Traders who write an option receive a fee, or premium, in exchange for giving the option buyer the right to buy or sell shares at specific price and date.

As an AMM, traders no longer have to worry about market making, strike prices or expiration dates.

Write Options

Trade Options on the Ethereum network or Binance Smart Chain.

Staking Lots earn a 1% fee on traded options in the underlying token. This means that if you buy a staking lot in the ETH Staking Contract you will earn rewards in ETH. ETH rewards are also possible with Ethereum casino games. According to ethereum casino vergleich, Players can deposit and withdraw using Ethereum, and place bets and win also in the form of Ethereum.

Earn passive daily income in the tokens you want. Rewards are available for immediate withdrawl as soon as a newly created Call or Put option is confirmed on the Blockchain.

EARNInvestment Funds Secured Through Smart Contracts

We are dedicated to providing a professional DeFi Fund Terminal with everthing you expect to see from a hedge fund wrapped in smart contracts.

Options - Hedge Funds - Analytics - Margin DEX.

Initial release on the Binance Smart Chain with WBTC, ETH, BNB, LINK, UNI, COMP, BCH and more. This will be followed by a second roll out on Polygon.

DeFi smart contracts that oversee the investment system of the DeFi Hedge Fund. Fund investment policies and guidelines are written as smart contracts where 'code is law.'

A dashboard for tracking investment portfolios, options markets, staking rewards and liquidity yeilds on RISQ Protocol.

Perpetual RISQ is a non-custodial, decentralized margin exchange. Trade leveraged crypto assets with the posiblity to combine trades with RISQ Options.

RISQ Protocol

RISQ

BSC, ETH & Polygon

1 USDC = 1 RISQ

41,000,000 RISQ

100,000,000 RISQ

8,000,000 RISQ

8,000,000 RISQ

8,000,000 RISQ

35,000,000 RISQ

Absoulutly NOT, there is zero barrier to entry, you can buy options and or provide liquidity to pool without owning RISQ tokens. Crypto staking allows users to earn passive income by locking their digital assets to support blockchain operations. This process secures networks and rewards participants with additional tokens. Crypto staking platforms simplify the experience, offering user-friendly tools, flexible terms, and access to various coins, making staking more accessible and profitable.

Staking Lots can be purchased for 10,000 RISQ. Staking Lots earn the settlement fees on every option bought in the underlying crypto asset. There are a limited number of staking lots available for each token.

1 Call = 1 token of the underlying cryptocurrency. Meaning if you buy 1 WBTC Call option you are leveraging 1 WBTC.

RISQ Protocol will first deploy on Binance Smart Chain with future rollouts on Ethereum and Polygon (Matic Network)